proposed federal estate tax changes

Under a Senate Bill introduced by US. Here is what we know thats proposed.

What Are Estate And Gift Taxes And How Do They Work

The top federal capital gains tax rate would also increase to 25.

. The current 2021 gift and estate tax exemption is 117 million for each US. The proposals reduce the federal estate and gift tax exemption from the current 117 million inflation-adjusted for 2021 to 5 million inflation-adjusted. 234 million for married couples at a top rate of 40.

Call for free estate planning evaluation. Reduce the current 117 million federal ESTATE tax exemption to 35 million. However under the legislative proposals.

If passed the proposed increase on the rate of estate tax would move to 45 for estates valued between 35 million and 10 million 50 for. So a family could end up paying both a transfer tax and then an estate tax and with the exclusion set to return to a level somewhere around 6 or 7 million many farms would be subject to both. Estates and non-grantor trusts would also be subject to a 3 tax surcharge on modified adjusted gross income which includes ordinary and capital gains income over 100000.

Decreased Estate Tax Exclusion. The maximum estate tax rate would increase from 39 to 65. For the vast majority of Americans the federal estate tax the death tax has been a non-issue since 2010 when the exemption was raised to 5 million and indexed for inflation.

Since 2018 estates are only taxed once they exceed 117 million for individuals. The Biden Administration has proposed significant changes to the income tax system. The exemption is the.

The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to. Finally under the proposed changes. Since the 2021 federal gift and estate tax exemption was raised to 117 million per person by the Tax Cuts and Jobs Act in 2017 the vast majority of individuals and families havent had to worry about having to pay the federal estate tax.

The exemption was indexed for inflation and as of 2021 currently stands at 117 million per person. Ad Protect Your Property. Kristen Bennett and Stephen J.

Additionally these proposed tax rates would apply to taxable estates worth up to 1 billion. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Trust Planning ensures you do not lose what youve earned.

Lower Gift and Estate Exemptions. It includes federal estate tax rate increases to 45 for estates over 35 million with further. The current estate tax exclusion for an individual is 117 million effectively 234 million for married couples.

The 2017 Trump Tax Cuts raised the Federal Estate Tax Exemption to 1118 million for tax year 2018. These changes would dramatically increase the number of taxpayers subject to the estate tax and would eliminate many common estate. On March 25 the For the 995 Percent Act the Act was proposed in the Senate which if enacted would result in the most extensive changes to the federal estate and gift tax in decades.

Senator Bernie Sanders called the For the 995 Percent Act the lifetime estate tax exemption would drop to 35 million from the current 117 million level for an individual and 7 million from the current 234 million level for a married couple. Ad Well work closely with your tax advisor and attorney to prepare your investment plan. Proposed Changes to Tax Law Affecting Wealthy Individuals in 2022.

This is the highest exemption amount in history. Here are some of the possible changes that could take place if Sanders proposed tax changes become law. The top federal income tax rate for estates and non-grantor trusts would increase to 396.

The comment writes the following. But this could all change soon if revisions proposed by the Biden administration become law. Capital gains tax would be increased from 20 to 396 for all income over 1000000.

A person can currently transfer up to 117 million of assets at death without incurring any Federal Estate Tax. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. Free Call Talk To An Expert.

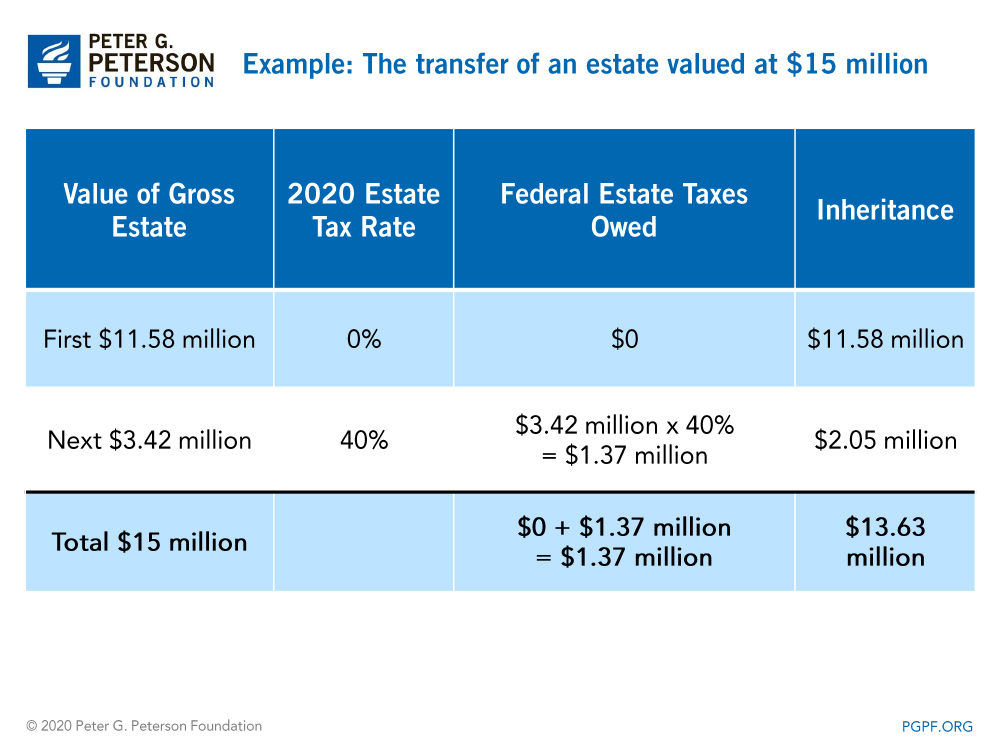

Proposed Estate and Gift Tax Changes. For example a 20 million estate with have an estate tax payable of 3320000. The law would exempt the first 35 million dollars of an individuals gross taxable estate or 7 million for a married couple from estate tax.

Call for free case evaluation. The first is the federal estate tax exemption. Ad Estate Planning Law Firms - Lawyer - Attorney Directory - Wills Trusts Tax Law.

Second the federal estate tax exemption amount is still dropping on January 1 2026 from 11 million to 5 million adjusted for inflation. Proposed 202010-1c3iD generally provides that the special rule does not apply to transfers includible in. Read on for five of the most significant proposed changes.

Under existing federal gift and estate tax law individuals can give up to 117 million couples 234 million tax free during life or upon death without triggering the death tax. Current federal estate tax law states that estates which exceed the exemption are subject to tax at the flat rate of 40. The tax reform proposals announced by the Administration in April and the General Explanations of the Administrations Fiscal Year 2022 Revenue Proposals.

That is only four years away and Congress could still. A persons gross taxable estate includes the value of all assets including even proceeds.

Estate Tax Definition Federal Estate Tax Taxedu

Twelve States And Washington D C Impose Estate Taxes And Six States Impose Inheritance Taxes Maryland Is The Only State To Inheritance Tax Estate Tax States

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

What Are Estate And Gift Taxes And How Do They Work

How Canadian Inheritance Tax Laws Work Wowa Ca

New Estate And Gift Tax Laws For 2022 Youtube

Eight Things You Need To Know About The Death Tax Before You Die

Time To Change Your Estate Plan Again

How Could We Reform The Estate Tax Tax Policy Center

Where Not To Die In 2022 The Greediest Death Tax States

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

What Is Estate Tax And Inheritance Tax In Canada

What Is Estate Tax And Inheritance Tax In Canada

How Could We Reform The Estate Tax Tax Policy Center

How Do State Estate And Inheritance Taxes Work Tax Policy Center